ACC: Development of biobased polyols for green polyurethanes has great potential

Commercialisation of a wider range of cost-competitive biobased polyols to drive expansion of sustainable PU segment

As the interest in sustainable products continues, demand for materials made from renewables-based poly-urethanes also continues to grow.

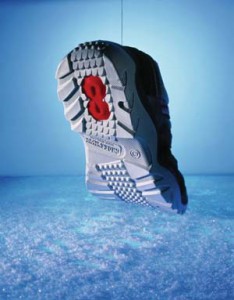

Natural oil polyols (NOPs) and sugars, which have long been raw materials for alkyd paints, are now used to make polyurethane (PU) foams for automotive applications, while thermoplastic polyurethanes (TPUs) from biobased polyester polyols find use in sporting goods, particularly shoes, and medical devices.

Commercialisation of a wider range of higher-performing, cost-competitive biobased polyols from both established polyol manufacturers and newer companies focused on the production of renewable materials will drive further growth of the sustainable PU segment.

Biobased polyols can be drop-in replacements for existing polyols, as they have similar structures and properties but are derived from renewable raw materials rather than petrochemicals, as well as substitutes for existing polyols that have slightly different structures and properties, or new compounds with entirely new functionality and performance characteristics.

As well as polyols based on natural oils (soybean, castor and palm) and sugars (sorbitol and sucrose), there are now commercially available polyols made from the biobased diols 1,3-propanediol (PDO) and 1,4-butanediol (BDO) and diacids, including succinic acid and larger acids such as Elevance’s Inherent C18 octadecanedioic acid (ODDA), as well as those produced using carbon dioxide (CO2), including polypropylene, polyethylene, polyether polycarbonate, and polycyclohexene carbonate (PPC, PEC, PPP, and PCHC, respectively) polyols, says Doris de Guzman, senior consultant, bio-materials and intermediates for Tecnon OrbiChem.

Other approaches, notes Marcel Lubben, president of Reverdia, include the manufacture of polyols based on chemically recycled polymers like polyethylene terephthalate (PET) and optimisation of production to reduce energy consumption, material use, and emissions of conventional processes.

Because the properties of PUs are closely tied to the properties of the polyols from which they are produced, it is critical that biobased polyols offer the performance needed for a given PU application.

“Along with a measurable advantage in sustainability, to facilitate market acceptance green polyols must also offer equal or better performance with no, or minimal, changes in handling and processing,” says Peter Shepard, chief business officer with Novomer.

The production process must also have a similar or improved profile with respect to energy and water consumption and waste and emissions generation, and the product quality must be the same as or better than traditional polyols, says de Guzman. In addition, many green polyols customers now prefer renewable materials that do not use food as feedstock.

Furthermore, says Shepard, biobased polyols should be offered at a similar price to that of the equivalent conventional products, particularly for drop-in replacements, because trying to capture a “green premium” severely limits market adoption. On the other hand, Lubben believes improved performance combined with the advantages of renewable content and carbon footprint reduction could lead to premium pricing.

“While many producers claim that the cost of bio-polyols must be competitive compared to petro-polyols, there is currently still a premium for biobased polyols, even natural oil polyols, that can be passed along the value-added chain,” de Guzman says.

“The quantity of renewable content in a finished polyurethane product is usually small enough to justify the premium in exchange for marketing the product as green or having a renewable content combined with the same properties as a PU manufactured from petro-based polyols,” she explains.

Trainers can benefit from biobased PUs

Photo: Bayer MaterialScience

“The focus within the broader market today is to find solutions that pair transformative performance with improvements in product sustainability, and this expectation applies to all major classes of polyols,” states Celene DiFrancia, senior vice president, engineering polymers & coatings with Elevance Renewable Sciences.

“To be successful, the technology must provide value to the application, which can take on many definitions. Substitute solutions can be interesting for NOPs as a green option, while performance solutions are value-added and compete on an equal basis to all options. Further, improved product quality and consistency via a better overall manufacturing process is also valuable,” she observes.

NOPs continue to account for the largest percentage of sustainable polyols on the market. “There are plenty of vegetable oil feedstocks available, the possibilities for producing polyols from vegetable oils are almost limitless, and the properties of NOPs can vary widely depending on the source of oil used,” de Guzman says.

DuPont produces PDO via the fermentation of corn and works with manufacturers of biosuccinic acid and other biobased chemicals to produce 100% biobased polyester polyols. Genomatica is the first major commercial supplier of bio-BDO through the fermentation of crop-derived sugars, but others are also producing or close to commercialising processes, including BASF through a joint venture with Purac, Myriant, BioAmber, and Metabolix.

BASF plans to produce biosuccinic acid, while BioAmber and Reverdia, a joint venture of DSM and Roquette, have commercial biosuccinic acid products on the market. BioAmber claims that 100% renewable polyester polyols made from biosuccinic acid, such as polypropylene succinate (PPS) and polybutylene succinate (PBS), offer a unique combination of performance, sustainability and economics.

Reverdia’s Biosuccinium is a potential replacement for conventional petro-based diacids like adipic acid in polyester polyols used to produce PUs with enhanced mechanical and chemical performance, such as TPUs and microcellular polyurethanes, says Lubben.

“We have seen a lot of interest around biosuccinic acid in the sporting goods, automotive, and coating and adhesive sectors, and Reverdia is involved in several application development projects with partners,” he says. Lubben adds that Biosuccinium has been shown to increase the chemical resistance of TPUs and the abrasion resistance of microcellular PUs, yet it is a near drop-in product so these PUs can be produced using processes similar to those used for the corresponding conventional products. Reverdia has been producing commercial supplies of Biosuccinium at its Cassano Spinola, Italy, plant since the end of 2013.

Renewable Sciences launched its Inherent C18 Diacid in September 2013. Polyester polyols made from ODDA address industry challenges with conventional TPUs, including moisture uptake, chemical resistance, product clarity, electrical properties, and adhesion of dissimilar materials, according to DiFrancia.

“Inherent C18 Diacid allows the PU market to expand product offerings in applications such as ski boots, automotive fuel lines, roller bearings, medical tubing, and sports equipment,” she says. The diacid is produced from products made at Elevance’s 180,000 tonne/year joint venture biorefinery with Wilmar International in Gresik, Indonesia, using proprietary metathesis chemistry. “The low-pressure, low-temperature process consumes significantly less energy and reduces greenhouse gas (GHG) emissions by 50% compared to typical petrochemical technologies,” DiFrancia says.

It takes longer for these types of polyols to be approved for commercial use in many applications. As they are not direct drop-in replacements, their performance must be demonstrated. Regulatory requirements are also very stringent in these markets and attaining the necessary approvals can delay product introductions, says de Guzman.

On the other hand, regulatory aspects may actually drive the adoption in construction applications of polyols manufactured from CO2, which is also a much less expensive feedstock compared with the feedstocks used to produce petro- and other biobased polyols. Producers of CO2-based polyols also report better performance/qualities in final PU products in certain applications.

Novomer launched its Converge polypropylene carbonate polyols for PUs in May 2014. The products are manufactured in a multi-thousand-tonne commercial-scale toll facility in Houston, Texas via the polymerisation of waste CO2 and epoxides.

“The unique polycarbonate backbone increases the strength and durability of polyurethanes, yielding foams with higher tensile and tear strength, and increased load-bearing capacity; adhesives and coatings with improved adhesion, cohesive strength, and weatherability; and elastomers with greater tensile and flexural strength,” Shepard says.

Furthermore, the calorific content (heat of combustion) of PUs produced using Converge polyols is 40-50% lower than conventional polyether, polyester, and polycarbonate polyols, which is particularly important in PU applications that must meet strict flammability requirements.

Meanwhile, Bayer MaterialScience’s Dream Production project resulted in a manufacturing process for the production of polyether carbonate polyols from CO2 and propylene oxide, according to Karsten Malsch, vice president of PUs. “We see great improvements in sustainability in both fossil fuel resource depletion and greenhouse gas emissions as they are 15-20% lower than conventional polyols.”

The polyols are designed for production of flexible PU foams, with mattresses targeted as the first consumer product. The research phase of the Dream Production project was completed in 2013, and BMS is planning to launch the first CO2-based polyols on the market starting in 2016. The company is producing pilot-scale quantities and will continue to support this endeavour to establish the process and product as an industrial standard.

“The development of biobased isocyanates is also receiving a lot of attention because if achieved, then 100% biobased polyurethanes could be obtained,” observes de Guzman. The development of isocyanate-free PU materials is also being investigated as an approach to avoiding the toxicity issues generally associated with isocyanates.

Source: ICIS Chemical Business, press release, 2014-09-19.