The rise of Carbon Dioxide (CO₂) as a renewable carbon feedstock – More than 1.3 million tonnes capacity for CO₂-based products already exist and are expected to at least quadruple by 2030

New report on the use of CO₂ for chemicals, advanced fuels, polymers, proteins and minerals by nova-Institute – A deep and comprehensive insight into the evolving technologies, trends and the dynamically growing market of CO2 transformation and utilisation

For the first time, the Intergovernmental Panel on Climate Change, in its 6th Assessment Report released in 2022 (IPCC 2022), recognises Carbon Capture and Utilisation (CCU) as one of the solutions to mitigate climate change. Several future scenarios for a net-zero chemical industry in 2050 show that between 10 and 30% of the demand for embedded carbon will come from the utilisation of CO2 (Kähler et al. 2023).

The potential of CCU has also been recognised by several global brands which are already expanding their feedstock portfolio. Cooperation along the value chain is key to ensuring that costs and benefits are properly balanced. In Europe, investments and prospects for CO2 utilisation are largely undermined by a lack of political support. In contrast, we see supportive policies in China as well as in the US with the Inflation Reduction Act. The US supports use of CO2 for fuels and chemicals from air capture and also from point sources, including commercial plants (de la Garza 2022). Such smart policies are needed to bridge the gap between now and 2050 for companies to remain competitive in the sustainable transformation.

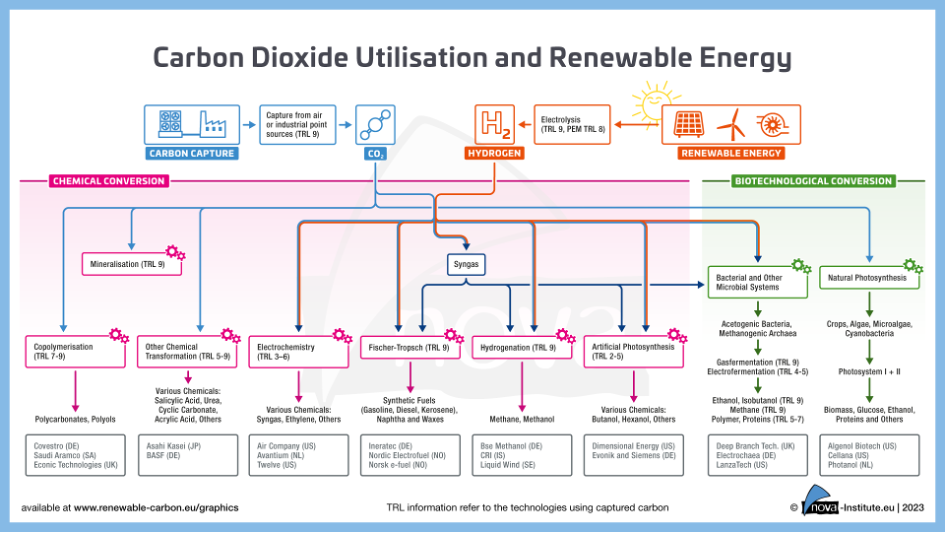

Fortunately, academia and industry have not waited to intensively develop and implement CCU technologies. Several successfully implemented technologies are now in commercial use, and many more are at the laboratory and pilot stage. Currently, CO2 and other C1-rich gases like carbon monoxide (CO) are captured from fossil and biogenic point sources, but also Direct Air Capture (DAC) projects are also multiplying. From there, CO2 can be converted via chemical, biotechnological and electrochemical pathways into chemicals, advanced fuels, polymers, proteins or minerals.

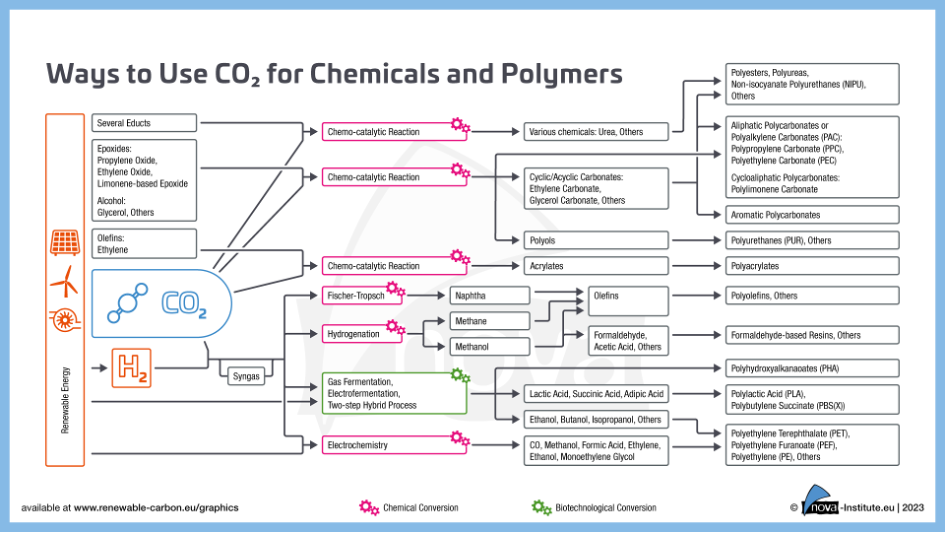

Conventional chemical conversion of CO2 has been used commercially for decades to produce chemicals such as salicylic acid, urea, ethylene and propylene carbonate. CO2 can also be used directly in applications like enhanced oil recovery, fire extinguishers or as plant growth accelerator in greenhouses. Novel chemical pathways focus on CO2transformation, the most promising at present being the hydrogenation of CO2 to methane or methanol. The former can be fed into the natural gas grid and contribute to the strategy of reducing the dependence on natural gas suppliers, while the latter can be easily and highly efficiently used as a fuel for the transport sector or as a chemical building block.

There is also considerable interest in the Fischer-Tropsch technology for the production of synthetic fuels and chemicals. This is a century-old technology mainly used for coal gasification and utilisation. Combined with CO2-based syngas, it can produce sustainable CO2-based hydrocarbons such as kerosene, diesel and naphtha as well as waxes. There is strong activity in CO2-based kerosene, the main Sustainable Aviation Fuel (SAF). There are also CO2-based polycarbonates, polyurethanes (PU) and polyethylene (PE) available on the market. Finally, CO2 can also be mineralised into a carbonate for construction materials: these technologies on the market use the carbonation process to produce substitute products for the cement industry.

The most notable CO2-based biotechnological conversion pathways produce methane and ethanol. The latter is produced on a commercial scale and is used as a fuel application and in the chemical (e.g. for ethylene glycol) and the polymer (polyethylene) industry. Additionally, biodegradable polymers called polyhydroxyalkanoates (PHA) can be produced via gas fermentation and are commercially available, and several other pilot plants are in operation for the production of chemicals and proteins via gas fermentation. The most advanced electrochemical pathways allow for the conversion of CO2 into CO (or syngas), methanol, formic acid or ethylene. Many pilot plants are running and CO (or syngas) production via this pathway will soon be implemented in a commercial plant, combined with Fischer-Tropsch technology for the production of a wide range of hydrocarbons.

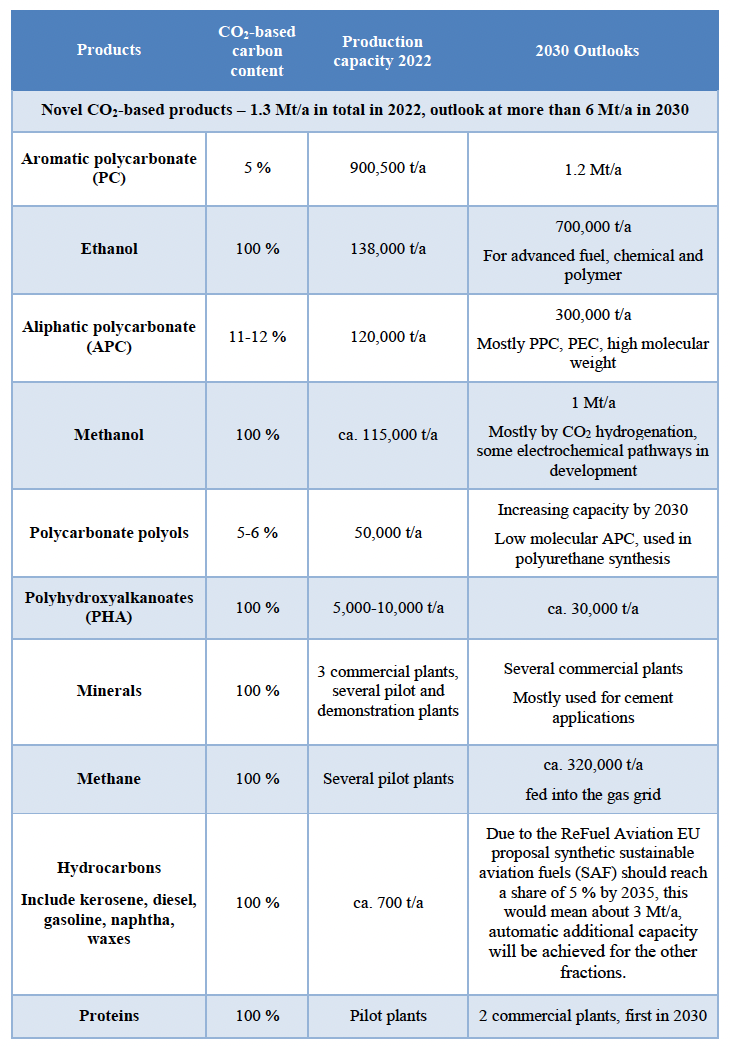

Table 1: CO2-based products: 2022 production capacity and 2030 outlooks

A current total production capacity of novel CO2-based products of about 1.3 Mt/a in 2022 is observed. The production capacity in 2022 is dominated by the production of CO2-based aromatic polycarbonates, ethanol from captured CO/CO2, aliphatic polycarbonate and methanol. By 2030, the capacity outlook for CO2-based products is expected to exceed 6 Mt/a of CO2-based products. High dynamic growth is observed for methanol projects, methane plants, ethanol and hydrocarbons – the latter especially for the aviation sector.

CCU-based products have lower greenhouse gas (GHG) emissions than comparable fossil-based products – if the entire energy used to capture and convert CO2 comes from renewable sources and green hydrogen. Already today, many technologies can achieve high GHG emission reduction up to 90 % when compared with fossil-based technologies.

nova-Institute’s new report examines this renewable carbon source in detail: Which products can be made from CO2, and by which processes? To which extend have the technologies already been developed and implemented in pilot, demonstration and commercial plants? Which companies are working on technologies to uses CO2 as a feedstock? What are the trends in CO2 utilisation in the coming years? This report addresses the fuel, chemical and materials industries, brands, technology scouts, investors, and policy makers. The report provides 240 pages of information on CO2 utilisation. All the 116 companies mentioned are described in detailed profiles.

“Carbon Dioxide (CO2) as Feedstock for Chemicals, Advanced Fuels, Polymers, Proteins and Minerals – Technologies and Market, Status and Outlook, Company Profiles” is available at https://renewable-carbon.eu/commercial-reports

CO2-based methanol as fuel or polymer building-block

Methanol from CO2 is currently one of the most advanced and most promising CCU pathways for the production of fuels and platform chemicals. This technology can be used as a storage system for solar and wind power – or as a feedstock for renewable chemicals (e.g. formaldehyde) or polymers (via the Methanol-to-Olefins technology). It can also be used as fuel additive and is of high interest for the shipping industry as an alternative fuel for ships, replacing heavy oil without changing the engines. nova-Institute has identified around 25 companies developing CO2-based methanol, mostly based on CO2 hydrogenation, a few of them are developing electrochemical pathways. In 2011, the pioneer company Carbon Recycling International (CRI) started operation of a methanol pilot plant in Iceland of 4,000 t/a. In 2022, a new plant started operation in China based on CRI licenced technology and two new plants are due to start up in China and Norway before 2025. Many other technology providers and other companies have announced future commercial plants before 2030 and the capacity should reach 1 Mt/a of CO2-based methanol.

The run to CO2-based hydrocarbons

Many companies are working on the utilisation of CO2-based syngas via Fischer-Tropsch technologies to produce tailor-made CO2-based hydrocarbons such as kerosene, diesel, naphtha and waxes. This is at present one of the most evolved technologies for the technical use of CO2. Strong focus is currently set on the kerosene fraction, due to the SAF quota, which is driving SAF projects extremely, secure markets, and push for high investments in European chemical parks. However, all these fractions are created during Fischer-Tropsch processes, and other products such as naphtha or waxes will be available for the chemical industry. Waxes, in particular, achieve good market prices. One of the first commercial plants based on CO2-based Fischer-Tropsch hydrocarbons is expected to start operations in 2025 and is run by the Norwegian company Nordic Electrofuel. They are planning a plant with a capacity of 10 ML/a and are progressively scaling up. All in all, nova-Institute has identified 15 companies developing CO2-based hydrocarbons. These are either technology providers of CO2-based syngas technology, using Fischer-Tropsch technology for the commercial production of fuels, or companies using others’ technologies to create value from their emissions, or consortia projects.

Biotechnological and electrochemical conversion to broaden the portfolio of CO2-based chemicals

Biotechnological CO2-conversion remains of great interest and shows potential for the production of many chemical building blocks and polymers. nova-Institute has identified 13 companies active in biotechnological conversion of CO2to chemicals. Key players have a broad portfolio and could offer chemicals such as methane, ethanol, lactic acid or butanol. One of the most advanced technologies in this field belongs to the company LanzaTech, which currently has three commercial plants in China and Belgium for CO2-based ethanol, used for fuel and ethylene synthesis. Another one belongs to the company Electrochaea, which produces methane that can be fed into the natural gas grid. Electrochaea had several industrial-scale pilot plants in Europe and US, and is aiming to produce more than 320,000 t/a of methane by 2025.

A lot of improvements have been made in the last years for the electroconversion of CO2 to chemicals, which led to increased interest from key players and the creation of several start-ups in this area. nova-Institute has identified 18 companies active in this development, focussing mostly on CO (or syngas), methanol, formic acid or ethylene. Many pilot plants are in operation and CO (or syngas) production via this pathway will soon be implemented in a commercial plant, combined with Fischer-Tropsch technology for the production of hydrocarbons.

Main CO2 utilisation for polymers

CO2-based polycarbonates are already commercially available from various suppliers. One of the largest volumes available is aromatic PC, based on the technology licenced from Asahi Kasei. The total production capacity of approximately 900 kt/a aromatic PC is equivalent to approximately 16 % of the total global aromatic PC production capacity. Additionally, several players worldwide are offering aliphatic polycarbonates such as polypropylene carbonate (PPC) for a wide range of applications. High molecular weight versions are used for thermoplastic application, while low molecular weight versions are used as polycarbonate polyols and find application in the PU sector, for foams or coatings. The amount of CO2 incorporated can reach up to 50 % by weight for these types of polymers. nova-Institute has identified 14 companies developing CO2-based polycarbonates for various applications. These companies are mostly based in Asia.

In addition, nova-Institute has identified 5 companies developing CO2-based PHA, with one company, Newlight Technologies, having reached commercial capacity and is planning to expand it by 2024. Finally, many CO2-based chemicals can be used in polymer applications and some companies have projects targeting this end use.

Food and feed from CO2-based proteins

Single-cell proteins (SCPs) are microorganisms or isolated proteins microbially synthesised. Microorganisms are not only capable of producing large amounts of protein, up to 70 %, but also provide high amounts of fatty acids, vitamins and mineral salts. They can be used as animal feed and for human consumption. CO2-based SCP can offer a promising alternative to meet the growing protein demand while bypassing an increase in animal feedstock for animal-based protein production. nova-Institute has identified 13 companies developing CO2-based protein through biotechnological conversion. These companies are mostly based in Europe and North America. Some technologies have reached pilot scale and the first commercial plant should be opened in 2023 in Finland, by the company Solar Foods.

Building with CO2-based minerals

Ex-situ mineralisation, or enhanced rock weathering (ERW), can be used in laboratory environments or industrial plants. There are some technologies on the market that use the carbonation process to produce substitute products for the cement industry. Industrial waste such as blast furnace and steel slag can be used as feedstock. These technologies enable cement production with a lower carbon footprint as an alternative building and construction materials. nova-Institute has identified 15 companies developing CO2-based mineralisation. These companies are mostly based in Europe and North America. Some technologies have reached the commercial scale, such as those developed by the company GreenOre, often being implemented close to other industrial waste sources. Several other commercial plants will be in the planning by 2030.

References

De la Garza, A. 2023: The Inflation Reduction Act Includes a Bonanza for the Carbon Capture Industry (www.time.com). Last access 23-03-01. https://time.com/6205570/inflation-reduction-act-carbon-capture/

IPCC 2022: Climate Change 2022 Mitigation of Climate Change. Last access 2022-12. https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_FullReport.pdf

Kähler, F., Porc, O., Carus, M. 2023: RCI Report: Carbon Flows. Compilation of supply and demand of fossil and renewable carbon on a global and European level. Renewable Carbon Initiative, February 2023 (Ed.), Download at www.renewable-carbon-initiative.com

About nova-Institute

nova-Institute is a private and independent research institute, founded in 1994; nova offers research and consultancy with a focus on the transition of the chemical and material industry to renewable carbon: How to substitute fossil carbon with biomass, direct CO2 utilisation and recycling. We offer our unique understanding to support the transition of your business into a climate neutral future.

Source:

nova-Institute, press release, 2023-04-12.