The fossil fuel trap: Why defossilising chemistry is essential – and feasible!

Renewable energy and carbon for climate protection, independence, resilience and competitiveness

Two things are needed to achieve a net-zero chemical industry: decarbonisation of energy and defossilisation of feedstock. Firstly, the process energy – the chemical industry is one of the three largest energy consumers in the EU – must be generated sustainably. This can be achieved by electrifying steam generation and other process steps, for example through electric steam crackers. And yes, it will require large amounts of renewable electricity. Secondly, the raw materials and thus the materials used in the chemical industry itself must be converted to renewable carbon.

It is not only important to maintain a strong, innovative and sustainable chemical industry in Europe, but to also prepare and transform it for the future, because chemistry is the backbone of all industrial production. In 2023, the chemical industry in the European Union had a turnover of around 665 billion euros (Statista 2025). This figure is twice as high when indirect effects are included. In many EU countries, the chemical industry is one of the most important sectors in terms of value added. When considered alongside the derived rubber and plastics industries, it is even the largest industrial sector in some member states. And together with the pharmaceutical sector, the chemical industry employs 3.4 million people, accounting for 12.3% of total employment in the manufacturing sector in the EU27 (CEFIC 2025). It is estimated that indirect jobs along the value chain number up to 20 million.

Fossil carbon, extracted from the ground in the form of crude oil, natural gas and coal, is not only the main cause of climate change, accounting for around 90% of emissions, it is also becoming an increasingly significant problem for the chemical industry in Europe. In particular, the continuing high demand for oil and natural gas makes Europe vulnerable, as it creates dependencies on imports and thus on the producing countries and the changing global political landscape. These, in turn, determine availability and prices.

Although oil consumption in the European Union fell from 400 million tonnes in 2014 to 355 million tonnes in 2023, imports still accounted for between 82–84% of consumption during this period. Depending on the EU member state, around 10 to 15% of oil is used for chemical and plastics production.

Natural gas consumption also fell from 330 million tonnes in 2014 to 230 million tonnes in 2023. However, the EU's own production of natural gas has fallen even more sharply, with the import share rising from 83% in 2014 to 89% in 2023.

Nuclear energy cannot overcome this dependency. Demand for uranium has remained constant at around 12,000 tonnes per year in the EU for the past ten years, but is 95% based on imports – mainly from Russia and out of scope of any current sanctions or restrictions.

The decline in demand for oil and natural gas is mainly due to the rise of renewable energies and efficiency measures, as well as the relocation of energy-intensive production outside of Europe, primarily to Asia. Nevertheless, this decline is still not sufficient to achieve net-zero targets by 2050.

The transition to a resilient and independent energy supply for the EU has so far only been successful in the electricity sector. Despite the increasing number of electric cars and heat pumps, electricity demand has fallen from 2,600 TWh in 2014 to 2,420 TWh in 2023, mainly due to efficiency measures and structural change in industry. At the same time, the share of renewable energies in the electricity sector has risen from 28–30% in 2014 to an impressive 46–47% 2024, with a further upward trend. A share of 66–69% is expected by 2030. The current target of the EU Commission's is even 90% by 2040. China has similar plans, with the share of renewable electricity set to reach around 95% by 2050.

Is the high share of renewable electricity generation the reason for the comparatively high electricity prices in Europe? Not at all. In fact, solar and wind power are the cheapest sources of electricity in the EU. However, these sources can only be realised on the market if the necessary infrastructure with powerful distribution networks, large (battery) storage facilities and electrolysis plants for hydrogen production is fully implemented. If the energy transition is implemented only hesitantly, the result would be the most expensive option: high investments in infrastructure are already made, but without full implementation we will not be able to harvest cheap renewable energy. This will jeopardise EU industrial production.

Cheap renewable electricity in Germany

Grid bottlenecks and the lack of battery, pump and pressure storage systems cost German taxpayers hundreds of millions of euros each year. For example, in 2024 renewable energy producers received compensation payments of 553.94 million euros from the federal government for wind and solar power that was not produced (“phantom electricity”). The reason was that operators had to shut down their plants because the electricity could not be fed into the grid due to bottlenecks in the power grid and a lack of demand – for example, from battery storage systems and electrolysers. At such times, solar and wind power prices fall below 5 cents per kWh, sometimes even reaching negative prices on the electricity stock exchange.

Cheap electricity from renewable energies is only possible over longer periods if Germany has large battery storage facilities – used electric car batteries are a cost-effective option – as well as electrolysers and hydrogen. A half-hearted implementation of the energy transition is the most expensive option. China has recognised this and is systematically expanding its battery storage facilities. The country already accounts for 50% of the world's battery capacity. However, the new German government is prioritising the construction of 40 natural gas-fired power plants instead.

The widespread use of battery, pump and pressure storage would enable a 24-hour price of 3 to 7 cents per kWh in Germany during the six summer months, with significantly lower fluctuations. This would stabilise and buffer prices. However, it would require accelerated expansion of storage capacity to over 100 GWh by 2030, as well as regulatory adjustments such as the Solar Peak Power Act, to promote direct marketing and grid-friendly storage management.

In order to make surplus solar energy from summer available for electricity and heating in the winter months, hydrogen (or methanol from green hydrogen and CO2) is needed as a long-term storage medium.

In order to make surplus solar energy from summer available for electricity and heating in the winter months, hydrogen (or methanol from green hydrogen and CO2) is needed as a long-term storage medium.

What does this mean for the future of the plastics industry?

The future of the chemical and plastics industry in the European Union depends primarily on energy and raw material prices, research and development, and the scaling up of innovations in Europe.

If the energy transition is implemented consistently, including grid expansion, (battery) storage and hydrogen, attractive electricity prices are on the horizon in the medium term. However, energy and raw material supplies are still far too dependent on fossil fuels such as oil, natural gas and coal, with imports accounting for 80–90% of the total. This makes European industry vulnerable in terms of access and prices. Simply put, the EU will never obtain fossil carbon at the price level of the producing countries and their allies. Since the most advanced technologies for the high-volume production of chemicals and plastics are available everywhere, countries with cheap access to oil and natural gas have a natural advantage. Europe cannot overcome this competitive disadvantage as long as the chemical and plastics industry relies on fossil carbon for over 90% of its feedstock.

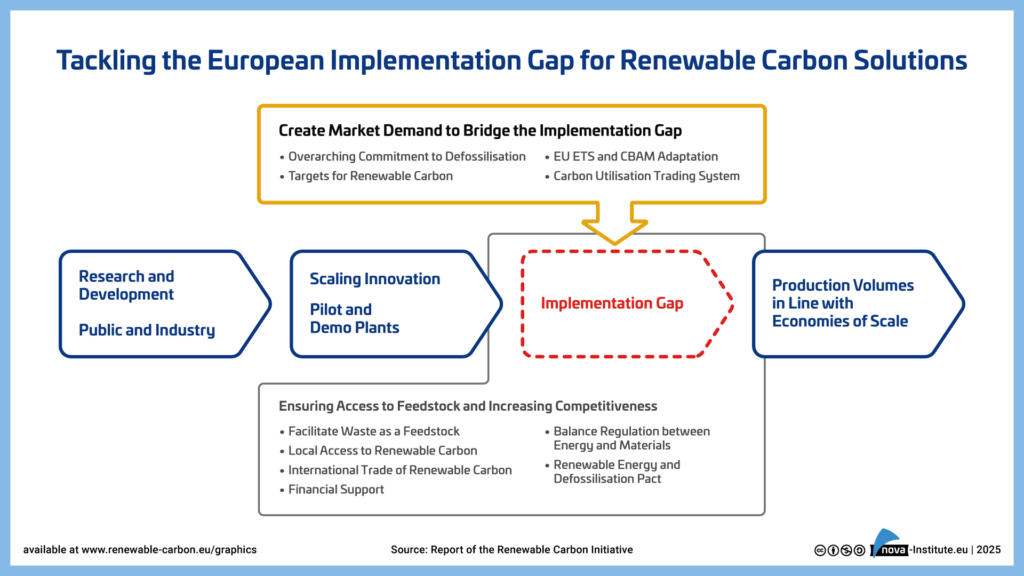

Is there a way out? Yes, Europe can become a pioneer in defossilising the chemical and plastics industry through the use of renewable carbon, thereby freeing itself from the fossil fuels trap. Renewable carbon means carbon from the recycling of plastics, biomass and CO₂. Europe is well positioned in terms of research and development in all three areas. Unfortunately, however, only in a few cases has it been possible to scale up innovations towards market implementation (“implementation gap”). In most cases, conditions for actually building market-size plants for new innovations are better in other regions of the world.

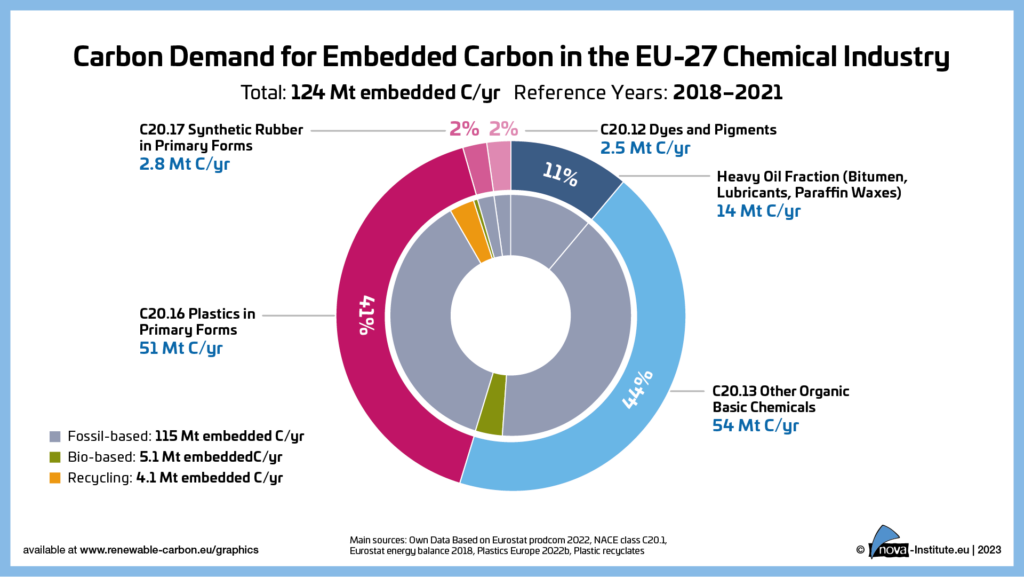

Defossilisation is also essential to achieving climate targets through a net-zero chemical and plastics industry. Replacing fossil carbon with renewable carbon in chemicals and plastics will play a key role to tackle industry's Scope 3 emissions, as the embedded carbon is responsible for the majority of the carbon footprint of chemicals and plastics.

Mechanical, physical and chemical recycling

Approximately 50 million tonnes of plastics are used in the EU each year, most of which comes from domestic production. Around 10–15 million tonnes were imported in 2023 as primary plastics, semi-finished products or end products. In 2022, a total of around 16.2 million tonnes of plastic waste was generated in the EU in the packaging sector alone, of which 40.7% was recycled – however, 1.3 million tonnes of this was outside the EU.

Plastic waste will therefore play a key role in the transition to renewable carbon, as it can replace significant amounts of imported fossil carbon. All plastics that reach the EU are valuable resources which should remain in the EU and be used as efficiently and to as high a standard as possible and kept in the loop, creating a circular economy.

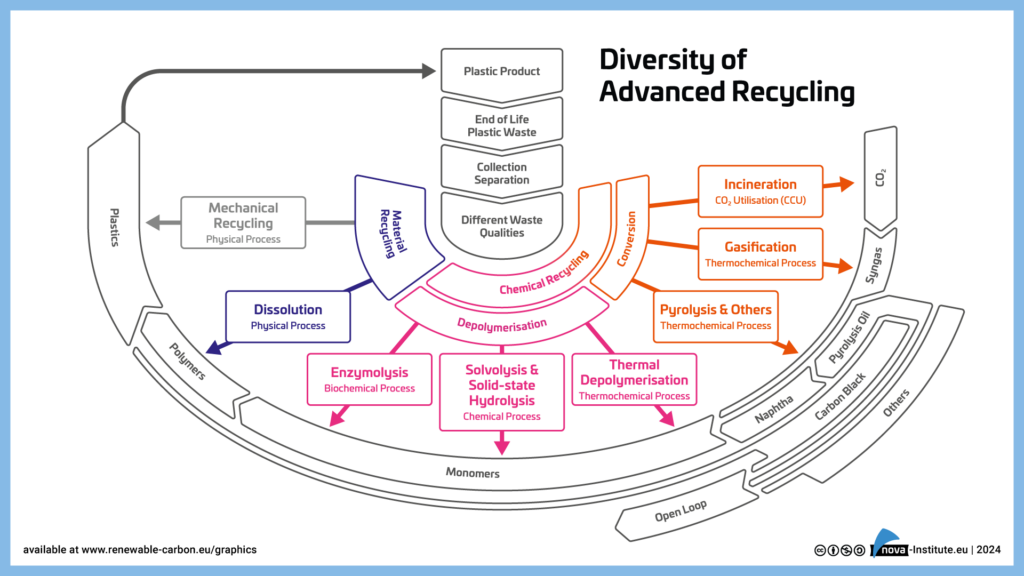

What needs to be done to realise this potential? All recycling technologies – from mechanical recycling to gasification (see chart) – must be implemented quickly, as they are all needed for the various waste streams and target products. The substantial investments required for this require clear, reliable and demand-generating framework conditions from policymakers. This includes introducing quotas in all areas of application, clarifying which recycling processes are accepted for quota fulfilment, and recognising mass-balanced plastics within these quotas. In addition, harmonised standards for the labelling and transport of plastic waste within the EU are required.

Only then can the potential and importance of recycling be fully realised. The EU recycling industry is currently in a very difficult position due to unfavourable framework conditions and cheap imports of new materials. It is hoped that the EU will adopt the necessary framework conditions this year, which would lead to a sharp increase in investment.

Recycling quotas in the EU for packaging and cars

The EU has already taken relevant steps to adapt the regulatory framework. For example, the EU Packaging Regulation (PPWR) introduced minimum quotas for the use of recycled raw materials in packaging for the first time: the recycling share of general plastic packaging must be 30% by 2030 and 65% by 2040. The Single-Use Plastics Directive (SUPD) contains targets for the proportion of recycled material in plastic beverage bottles. Specifically, the proportion of recycled material in PET bottles is to be increased to 25% by 2025 and 30% by 2030. The amendment to the End-of-Life Vehicles Directive (ELV-R) currently under discussion also proposes introducing a recycling quota for plastics. This is to apply from 2030, with the exact level (20–25%) still to be negotiated.

Bio-based and CO2-based plastics

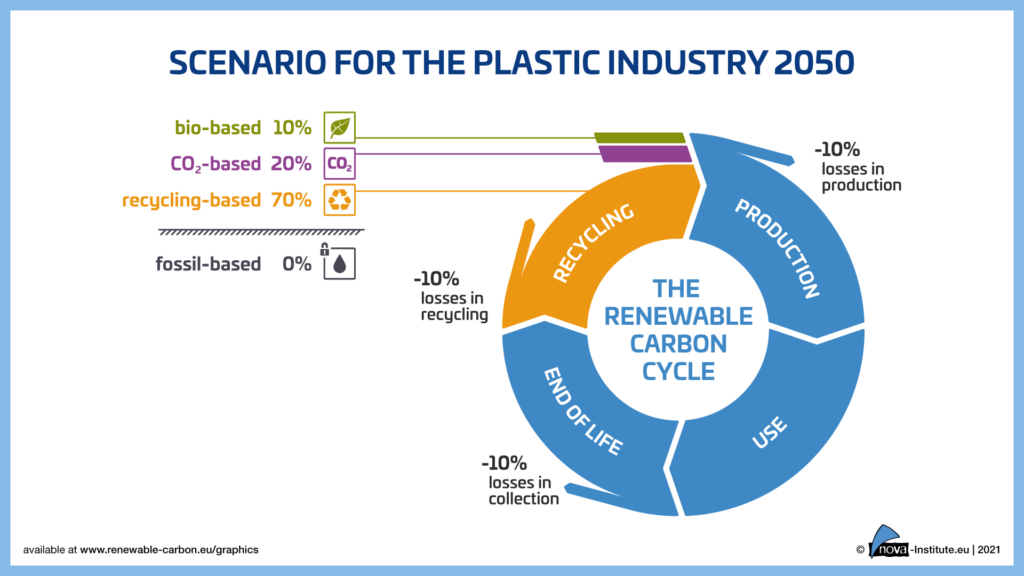

Even in an ideal world, recycled carbon will never be enough to completely replace fossil carbon (see image). Today, only 10% of plastics are made from recycled materials. Under ideal conditions, this share could be increased to 50–70%. However, there will always be unavoidable losses during collection and processing. This means that additional non-fossil carbon sources are needed. These are biomass and CO₂.

Today, worldwide there are 17 commercially available bio-based plastics that can be used in almost all applications. Despite high R&D spending, Europe has been falling behind as a manufacturing location for bio-based plastics for years and is expected to only achieve a 13% market share in 2024 – compared to 59% in Asia. Investments are flowing into countries with the right political framework and, above all, where market demand has been created. Europe will need to follow suit quickly it it wants to exploit this option for defossilisation. Currently, Europe is discussing its first own bio-based quotas, initially looking to set a low quota (for example 5%) by 2030 or 2035 for packaging and potentially automobiles. These first steps must be introduced urgently if Europe does not want to fall behind in the bioeconomy. And in addition, further clear and reliable rules must be established: acceptance of the use of agricultural raw materials such as starch, sugar or vegetable oils (which actually increase food security as they can serve as emergency reserve), the use of established sustainability criteria from the biofuel sector, and acceptance of mass balance and attribution (MBA).

CO₂-based plastics should also be eligible for counting towards the quotas. This applies both to the use of fossil CO₂ in the recycling quota and to biogenic or atmospheric CO₂ in the bio-based quota, in order to give them market access as well. They do not yet play a role in the market, but with increasingly available, inexpensive solar and wind energy, they will become a real option. With an electricity price of 3–4 cents/kWh, hydrogen prices could fall so low that production from this hydrogen and CO₂ from point sources (fossil and biogenic, e.g. pulp and paper industry, bioethanol and food fermentation) would become competitive with biogenic or recycling routes. In addition to special routes, the methanol route is of particular interest as it can be used flexibly as either a fuel or a chemical raw material. Furthermore, side streams from the production of sustainable aviation fuels from CO₂ (secured by quotas) can be utilised in plastics production. It is important to open the doors early on in order to cover these expected side streams in a forward-looking regulatory manner.

Often overlooked, CO₂-based plastics should also be eligible for counting towards the quotas. This applies both to the use of fossil CO₂ (counted in the recycling quota) and to biogenic or atmospheric CO₂ (counted in the bio-based quota), in order to provide them market access as well. They do not yet play a role in the market, but with increasingly available, inexpensive solar and wind energy, they will become a real option. With an electricity price of 3–4 cents/kWh, hydrogen prices could fall so low that plastic production from this hydrogen and CO₂ from point sources (fossil and biogenic, e.g. pulp and paper industry, bioethanol and food fermentation) would become competitive with biogenic or recycling routes. In addition to many specific routes, the methanol route is of particular interest as it can be used flexibly either as a fuel or a chemical raw material. Furthermore, side streams from the production of sustainable aviation fuels from CO₂ (secured by quotas) can be utilised in plastics production. It is important to open the doors early on in order to cover these expected side streams in a forward-looking regulatory manner.

Conclusion

In the long term, recycling, together with biogenic carbon and CO₂, can completely replace fossil carbon from crude oil or natural gas as a raw material for plastics production. This will enable the European Union to become independent of fossil carbon imports and increase its resilience and competitiveness. To achieve this, it is crucial to shape the transition phase in a politically astute and rapid manner so that the transformation of the chemical industry in Europe is successful – after all, Europe is the birthplace of modern chemistry. This is the only way to prevent the EU from remaining stuck in a fossil fuel trap while other regions successfully transform their economies.

Europe was the innovation driver of the global chemical industry and can become so again – this time on the basis of its own raw materials, innovation and sustainability. This will allow a larger share of value creation to be retained in the EU, which will ultimately also support and protect Europe's political system.

Conferences of the nova-Institut on a net-zero chemical industry and non-fossil plastics

The nova-Institut in Hürth near Cologne has established two leading conferences that show how the defossilisation of the chemical industry and the transition to non-fossil plastics can look in practice. Leading brand manufacturers, large companies, innovative SMEs and start-ups come together to explore and develop opportunities for transformation in lectures, panel discussions, workshops, exhibitions and poster sessions.

The next Renewable Materials Conference (RMC) will take place from 22 to 24 September 2025 in Siegburg/Cologne. More than 500 participants are expected to attend. The topics cover the entire spectrum of renewable carbon: biomass, CO₂ and recycling.

https://renewable-materials.eu

The Advanced Recycling Conference (ARC) will take place from 19 to 20 November 2025 in Cologne. Over 300 participants are expected to attend. The conference will focus on physical and chemical recycling processes, a highly dynamic market.

https://advanced-recycling.eu

Source: nova-Institute, original text, 2025-07-23.